From Struggles to Strength:

How Edwards & Associates Empowered Robinson Dental Practice

Introduction

Amid the pandemic’s challenges, Edwards & Associates emerged as the strategic partner Dr. Brent Robinson needed, offering not just financial solutions but a deep understanding of his passion for dentistry. Their sophisticated and empathetic approach revitalized Robinson Dental, transforming obstacles into opportunities for sustainable growth. This partnership went beyond numbers, enriching the practice and giving Dr. Robinson the freedom to focus on what he loved most—his patients.

The Challenge

For Dr. Brent Robinson, dentistry wasn’t just a career; it was a deeply personal journey filled with passion and dedication. But after years of engaging with various CPA firms, he felt like something was missing. “I was seeking authenticity,” he reflects, “a partner who wouldn’t just crunch numbers but truly understood my world.” When the pandemic hit, it was more than just a financial hurdle—it was a test of resilience, demanding a partner who could navigate both the emotional and professional challenges.

The Solution

From the very first encounter with Edwards & Associates, Dr. Robinson knew he was in for more than just a typical business transaction. The meeting felt less like a formal discussion and more like a heartfelt conversation among friends who genuinely cared about his success. “They didn’t just listen to my concerns; they empathized.” Edwards & Associates rolled up their sleeves and went right to work restructuring accounting systems to align seamlessly with dental industry standards. This was not just a technical shift; it was a revitalization of Dr. Robinson’s practice, aligning with his values and setting the stage for sustainable growth and profitability.

But Edwards & Associates didn’t stop there. They provided a wealth of resources, including webinars, podcasts, and blogs, which not only informed but also reassured. During times of uncertainty, these resources imparted a sense of community and support.

The Results

The transformation was palpable. With Edwards & Associates handling the intricate financial details, Dr. Robinson experienced a pivotal shift, not just in operations but in peace of mind. “It was like having a trusted co-pilot on this journey,” he describes. The proactive measures they took — like identifying fraudulent activity or managing audits —weren’t just services; they were acts of guardianship, allowing him to channel his energy where it was most needed. The new-found freedom and assurance were reflected in the smiles of his patients and the harmony within his team.

Testimonial

“Imagine having a partner who not only shares in your challenges but celebrates your victories. Working with Edwards & Associates has been more than a professional relationship; it’s been a partnership filled with trust, integrity, and warmth. They don’t just manage my finances—they enrich my practice. Their genuine investment in my success is a rare gem in the business world. To any fellow dentist, I say: find a partner who makes you feel this assured and valued—you deserve it.”

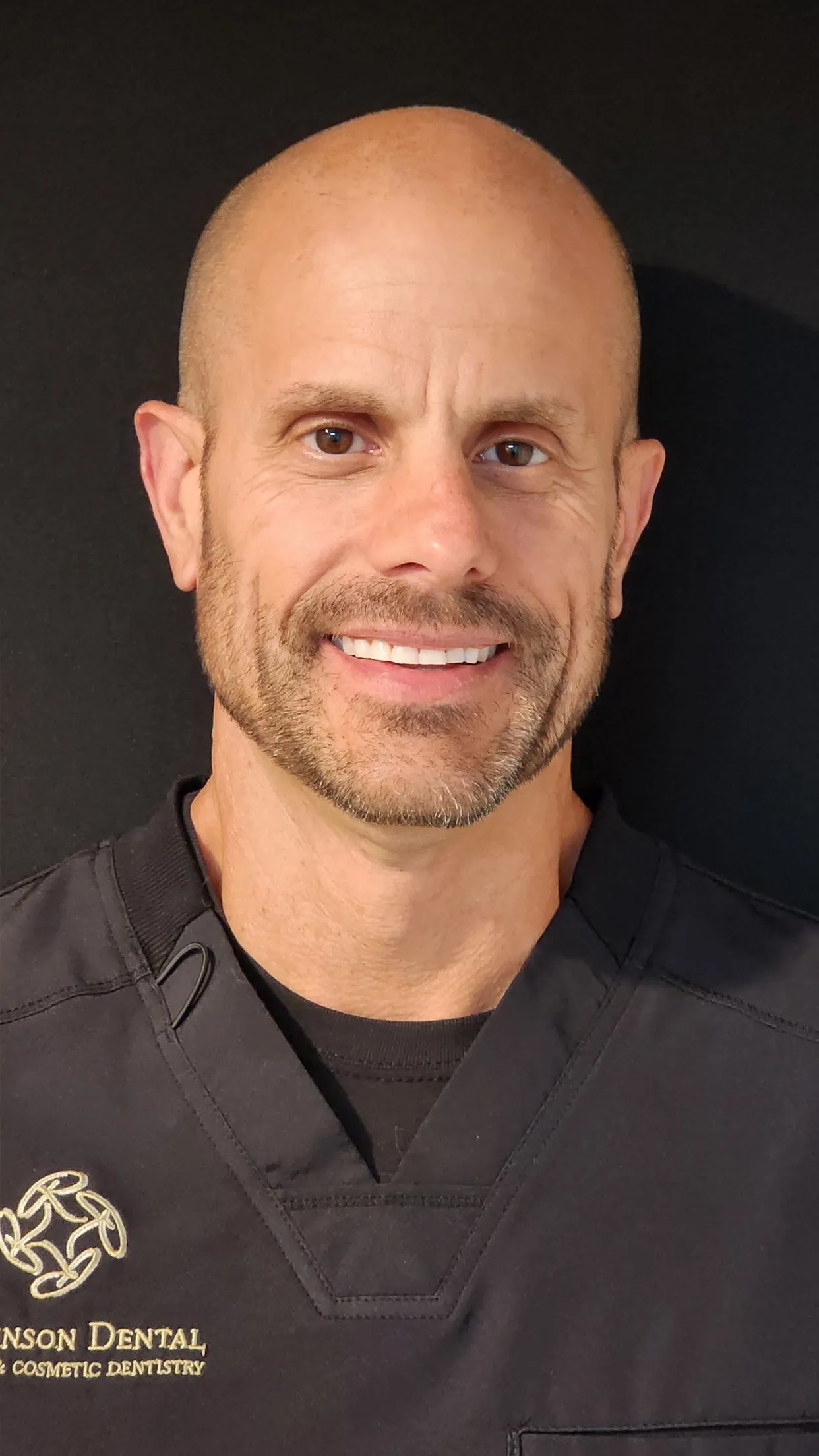

Dr. Brent Robinson

Are you ready to meet us?

We Are Your Financial Experts.

Related CPA Services

Monthly Core Services

Monthly Core Services In this stress-free accounting offering, we handle bookkeeping, taxes, financial reporting, and…

Financial Planning

Strategic Financial Planning for Dentists Secure your financial future with expert guidance tailored to dental…

Transition Services

Transition Services for Dentists Whether you’re launching a new practice, expanding, or preparing to sell,…

Dental Practice Consulting

Dental Practice Consulting Running a dental practice comes with unique challenges. Since 1987, our team of…

Have Questions?

Contact us at info@eandassociates.com or call us at (972) 267 9191 to schedule a consultation!

When Should I Start Thinking About Implementing a 401k Plan?

As soon as possible! The founder of our firm, Mr. Robert Edwards gets these questions all the time and he always answers them the same way: “I’m always encouraging our clients to save for retirement even when they starting their dental practice. Remember, if you do not put money away, you are more likely to spend it! You only stand to benefit by funding a retirement plan in the early years of your practice because you don’t have any other eligible employees.”

Are Dental Services Subject to Sales Tax?

It is important to remember that dental services and appliances are exempt from sale and use tax in most cases. However, the sales of non-prescription toothpaste and toothbrushes can be subject to sales and use tax.

If you decide to sell non-prescription items to your patients, the first step is to apply for a Sales and Use Tax Permit. You can apply for a permit online using Webfile. The Sales and Use Tax permit also allows you to be exempt from paying sales tax on any items that you purchase for resale.

Next, you need to set up your dental software to track taxable transactions to allow for accurate record keeping. Contact your software help desk for helping in creating the necessary monthly taxable activity reports.

If you are required to collect sales tax on nonexempt transactions such as toothbrushes and toothpaste, your reporting and remittance schedule depends upon how much sales tax you are collecting within a monthly, quarterly, or yearly time frame. You are required to file a Texas Sales and Use Tax Return (Form 01-117) and submit the collected tax based on the collection levels below:

- You must file Monthly if you collect $500 or more tax in a month.

- You must file Quarterly if you collect <$500 per month or <$1500 per quarter.

- If you collect less than $1,000 in tax per year, then you need only file one per year. However, if you are collecting close to this level of tax then a quarterly filing pattern is a safer option.

The Texas Comptroller allows multiple methods for reporting and payment including paper filing and Webfile.

Are Dental Practice Management Consultants Worth the Investment?

If you own a dental practice, you know that it’s a job that requires you to juggle many responsibilities. The reality is that not everybody is cut out to juggle everything required to run a dental practice, while also being a good dentist. And even if you are one of the few dentists that can “do it all”, how do you give it the time it deserves while also seeing patients and perfecting your craft?

Unless you’re prepared to hire an in-house team to run your business, you’ll have to look elsewhere for guidance and support. A great place to start is with a dental practice management consultant. A dental consultant helps dentists improve their practice by providing advice, training, and expertise.

This includes, but is not limited to:

- Coaching Your Team

- Building Patient Relationships

- Identifying Behavioral Styles

- Team Building

- Partnerships that Thrive

- Implementing Incentive Programs

- Equipment purchases

- Finances and billing

- Maintaining an Effective Hygiene Program

- Scheduling to Goal

Dental Practice Consultants are most useful when you are starting up a new practice, looking to expand your dental empire, or going through other transitional periods such as adopting new management software, onboarding new staff members, or selling your dental practice. Dental practice consultants can also be used to help you improve your practice efficiency and evaluate weak points. At Robert Edwards & Associates PC, we are lucky to have renowned dental practice consultant Dr. Sharon Tiger, who has decades of experience in helping dental practices make the best decisions to ensure success.