12/01/2020 2:17:14 PM

Recently the IRS solidified its position that expenses paid with PPP funds would not be deductible if you expect forgiveness on the loan. And we hadn’t heard any chatter from congress in months on this issue. We concluded that hope was fading on the issue. The same was true for PPP forgiveness applications. Many months ago there was optimism that loans under $150K would be easily forgiven under a streamlined process. Then the process was eased for PPP loans under $50K, and hope began to fade for loans between $50K and $150K.

BUT all hope is not lost yet! At approximately 10:30 am, a bipartisan, bicameral group of Senators and Congressmen held a press conference to roll out a framework/outline for COVID emergency relief legislation.

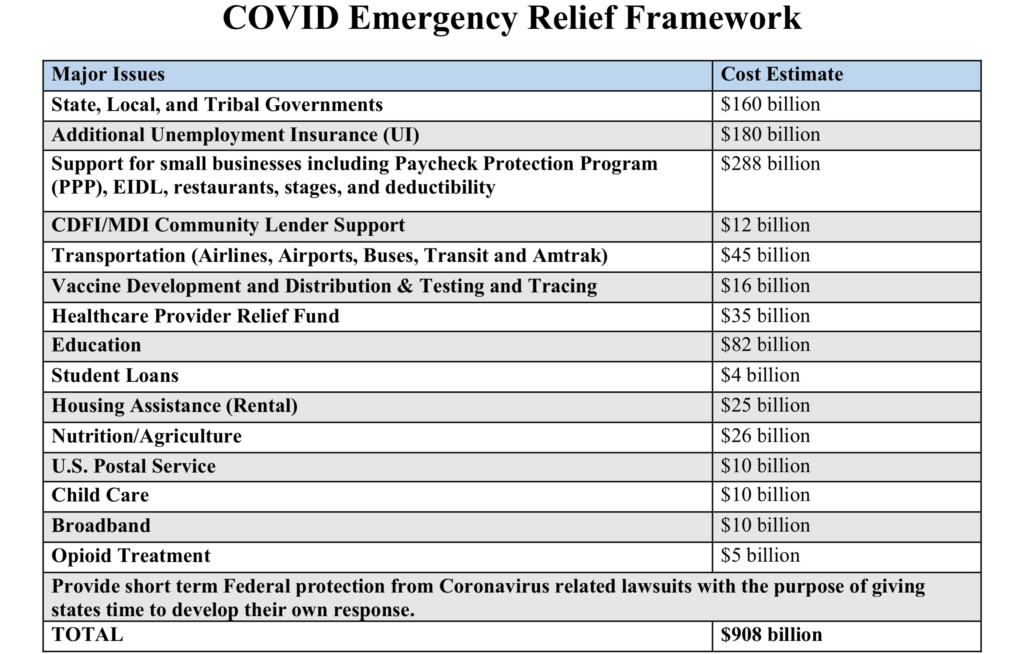

Will PPP expenses be deductible? Will the PPP forgiveness process for loans under $150K be simplified? It is still VERY uncertain how these 2 issues will ultimately conclude. But at least there are conversations taking place again. The intention is for something to be passed before the end of the year. Below is a chart of items being discussed for the current bill.