In the latest episode of Beyond Bitewings, Sarina Arzani, a third-year dental student from A&M College of Dentistry, joined the discussion to provide valuable insights for fellow dental students and young dentists. The focus of the episode was on the challenges new graduates face when transitioning from school to the business world of dentistry and how to effectively prepare for that transition.

The Gap Between Dentistry and Business Knowledge

Sarina highlighted a common concern among dental students: while they are equipped with extensive knowledge and skills related to dentistry, they often feel lost when it comes to the business side of running a practice. Many students, especially those nearing graduation, realize they lack the tools to navigate the financial, operational, and management aspects required for success after dental school. Sarina shared how her peers are searching for jobs but don’t know what to prioritize or where to start when evaluating potential employers or thinking about opening their own practices.

The Importance of Building a Strong Team

A key takeaway from the discussion was the importance of building a strong support team early on. Sarina emphasized that starting this process during the D3 or D4 year is crucial for feeling confident and prepared when entering the real world of dentistry. Whether it’s financial advisors, practice management experts, or networking with fellow dentists and vendors, surrounding yourself with a knowledgeable team can make all the difference. Sarina noted that dentists who are successful in both clinical practice and business consistently credit their support teams for much of their success.

Dealing With Information Overload

Sarina also touched on the overwhelming amount of information available to dental students as they approach graduation. From job offers to setting up a practice, knowing what advice to follow can be challenging. One strategy discussed was how building relationships with experienced professionals can help filter the most relevant and valuable advice. Having a network of trusted experts can simplify the decision-making process and reduce the confusion that often comes with entering the business side of dentistry.

Making Connections Early

Networking emerged as a key theme in the conversation. Sarina encouraged students to start making connections early, whether through conventions like the Southwest Dental Show where the podcast was recorded or via social media, where many dentists and professionals share valuable insights. By building these relationships and learning from others’ experiences, dental students can better understand the type of practice they want to create and the best way to achieve their goals.

Leveraging Social Media in Dentistry

Interestingly, Sarina, who is considered a social media influencer, spoke about the power of social media in dentistry. She described how platforms like Instagram and YouTube offer an excellent opportunity for networking, learning, and even marketing future dental practices. For those looking to stand out in today’s competitive environment, leveraging social media is becoming increasingly important, especially for reaching younger patients and staying connected with peers in the industry.

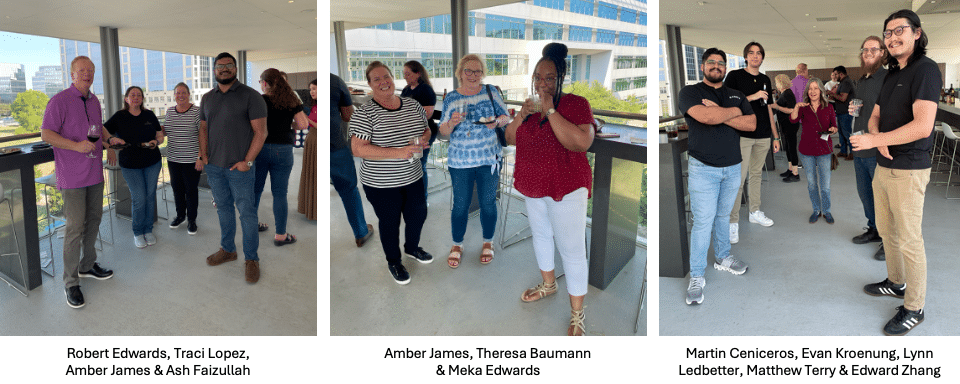

Support from Edwards & Associates PC

As a final note, Ash reminded listeners that they offer free contract reviews for new dental graduates entering their first associateships. With decades of experience in dental-specific accounting and financial services, the firm provides invaluable support for dentists at all stages of their careers. Whether it’s reviewing employment agreements, offering business advice, or helping with long-term financial planning, they are dedicated to supporting the dental community.