Dental practices are constantly juggling patients, employees, insurance claims, and the day-to-day operations. The last thing you need is to get caught in a scam, especially one that claims to come from the IRS.

Unfortunately, IRS scams are more common (and more convincing) than ever. Scammers know that small business owners are prime targets, and dental practice owners and managers are no exception. Here’s what you need to know to protect yourself, your team, and your practice.

Common IRS Scam Tactics

Scammers often impersonate the IRS through:

- Emails (“phishing”) that look official but contain malicious links or attachments.

- Phone calls claiming you owe taxes and demanding immediate payment.

- Text messages directing you to fake IRS websites.

- Mail that looks real but asks for unusual information or directs you to a fake phone number.

Important: The IRS will never initiate contact with you via email, text message, or social media to ask for personal or financial information. They primarily communicate through official mail.

How to Recognize an IRS Scam

Be on the lookout for these red flags:

- Urgency or threats. Scammers often pressure you to act immediately by threatening arrest, license suspension, or lawsuit.

- Requests for unusual payment methods. The IRS does not accept gift cards, cryptocurrency, or wire transfers for tax payments.

- Unfamiliar sender or strange-looking links. Hover over links before clicking, if the web address looks suspicious or doesn’t end in “.gov,” don’t click.

- Spelling or grammatical mistakes. Official IRS communications are professional and carefully worded.

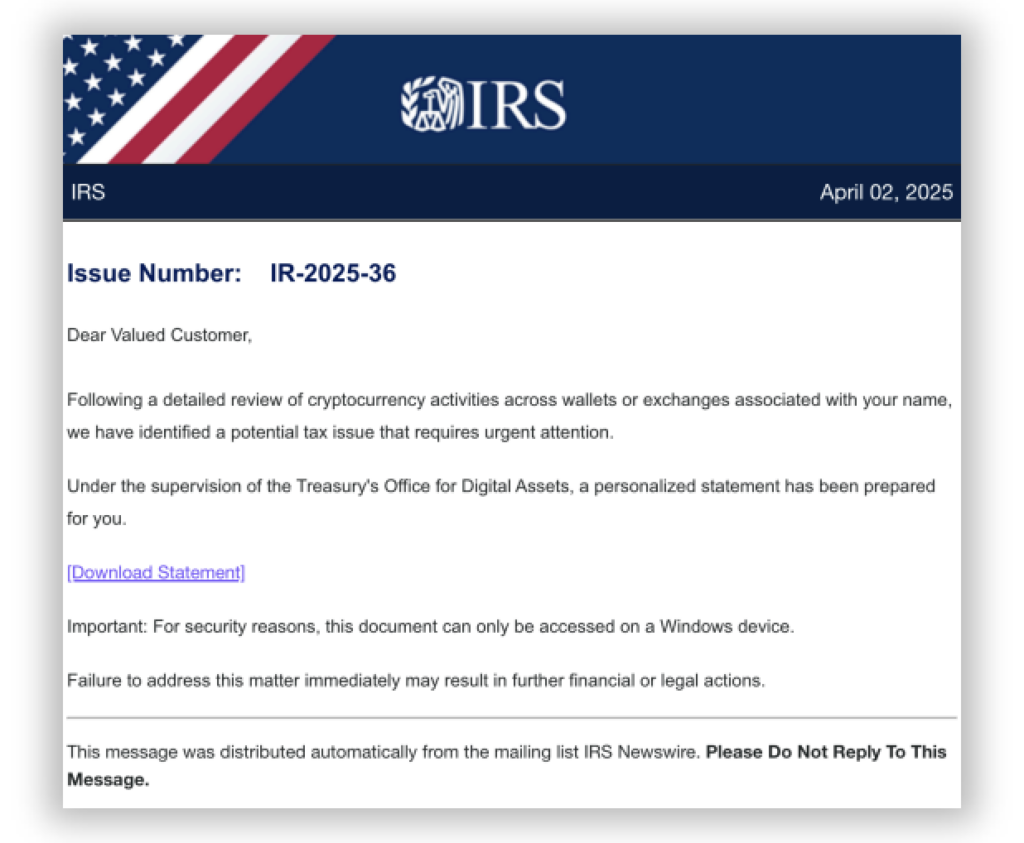

Here is an image of a specific scam email. On the surface, it looks legitimate. But you’ll notice a few things that are off on closer examination. First, it is an email, which is not how the IRS typically communicates. Secondly, the IRS is not likely to refer to you as a ‘valued customer.’ Third, there is some urgency to the message, and it is asking you to click on an unidentified link.

What to Do if You Receive a Suspicious Email or Call

- Don’t click on any links or open attachments.

- Don’t provide any personal information, not your Social Security number, bank details, or even your name.

- Hang up immediately if it’s a call.

- Report the scam. Forward phishing emails to phishing@irs.gov. You can also report scam calls to the Treasury Inspector General for Tax Administration (TIGTA) at tigta.gov.

What If You Accidentally Clicked or Responded?

If you clicked a suspicious link or provided information:

- Immediately run a virus scan on your computer.

- Contact your IT provider to check for any breaches.

- Monitor your bank accounts and credit reports for unusual activity.

- Report identity theft to the IRS at identitytheft.gov and file a report with the Federal Trade Commission (FTC).

It’s also a good idea to reach out to us if you shared any tax-related information. We can guide you on the next steps to help limit potential damage.

Protecting Your Practice Starts with Awareness

When in doubt, always double-check. Contact the IRS directly using the information on irs.gov, not a phone number or link provided in a suspicious message. And if you have questions about anything that feels ‘off,’ we’re here to help.

Your financial health is just as important as your patients’ dental health. Stay vigilant, stay informed, and don’t let scammers take a bite out of your business!